Put your growth on autopilot

GrowSurf is modern referral program software that helps product and marketing teams launch an in-product customer referral program in days, not weeks. Start your free trial today.

If you are a startup founder, there's a high chance you're losing sleep worrying about the success of your company.

Will you manage to attract investors? Will you be profitable? How high should you price your product?

What you need is to predict the future performance of your company. And the best to do so is with the help of a financial forecasting model. These models can tell you a great deal about your business, including how to gain more users, what to expect in terms of revenue, and more.

Find out the top 5 financial forecasting models and their benefits right here.

Financial forecasting is the process of predicting the financial performance of any company, whether you're a B2B self-service or a B2C subscription-based startup.

If the main goal of SaaS metrics and pirate metrics is to assess the health and growth of your company, the main goal of financial forecasting is to give the organization, investors, and other stakeholders a sense of its financial future.

Forecasting is used to prepare budgets, loan applications, and other financial decisions. For instance, SaaS businesses particularly struggle to determine their SaaS pricing strategy as there's no cost associated with producing the software. Well, financial forecasting can help a SaaS business come up with the best price to sell its product, and so much more.

Some of the most notable benefits of financial forecasting are the following:

A good financial forecasting model is the cornerstone of good governance. It helps an organization make good financial decisions in an efficient manner and makes the organization more transparent.

Financial forecasting models are specifically designed to address various areas of an organization's financial planning. These models help the company to clearly understand its financial performance and also provide vital information to investors.

The five best-known financial forecasting models for startups are:

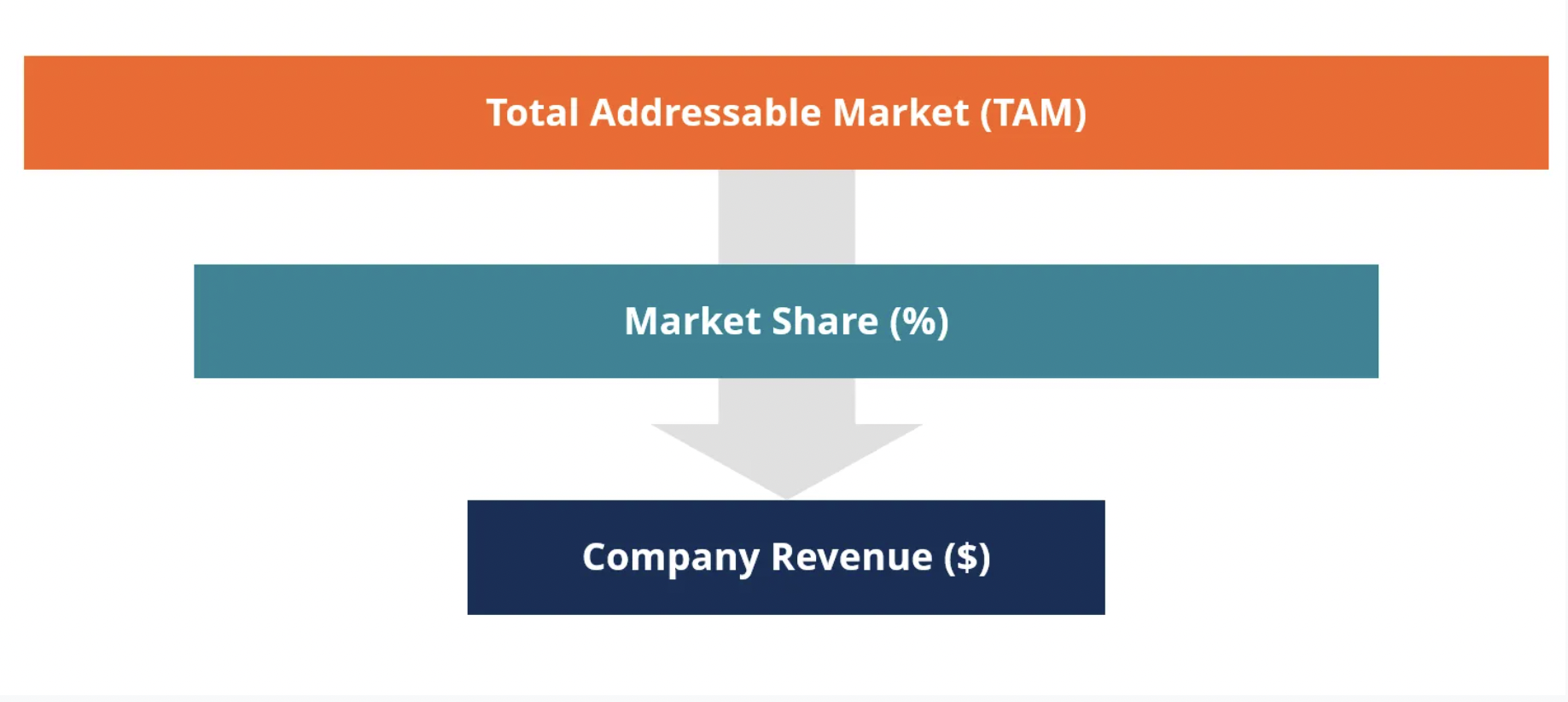

Image source: Corporate Finance Institute

There are many ways to forecast. One way is the top-down financial model.

This type of financial model starts with looking at the big picture, usually the market as a whole. It looks at macroeconomic variables such as gross domestic product (GDP), employment, demographics, and the like. The idea is that you start with the overall picture and then work your way down to more specific variables.

Based on these variables, a business can determine how much of the market will buy its product or service.

As this model tends to give a more optimistic outlook, many businesses use it to attract investors. In addition, this model is the preferred option when it comes to strategizing and allocating resources.

Another reason why startups may opt for this model is that you don't need the most recent point of sale data to generate projections. Even better, the top-down financial model can tell a business whether the market is increasing or decreasing and thus evaluate its long-term profit potential.

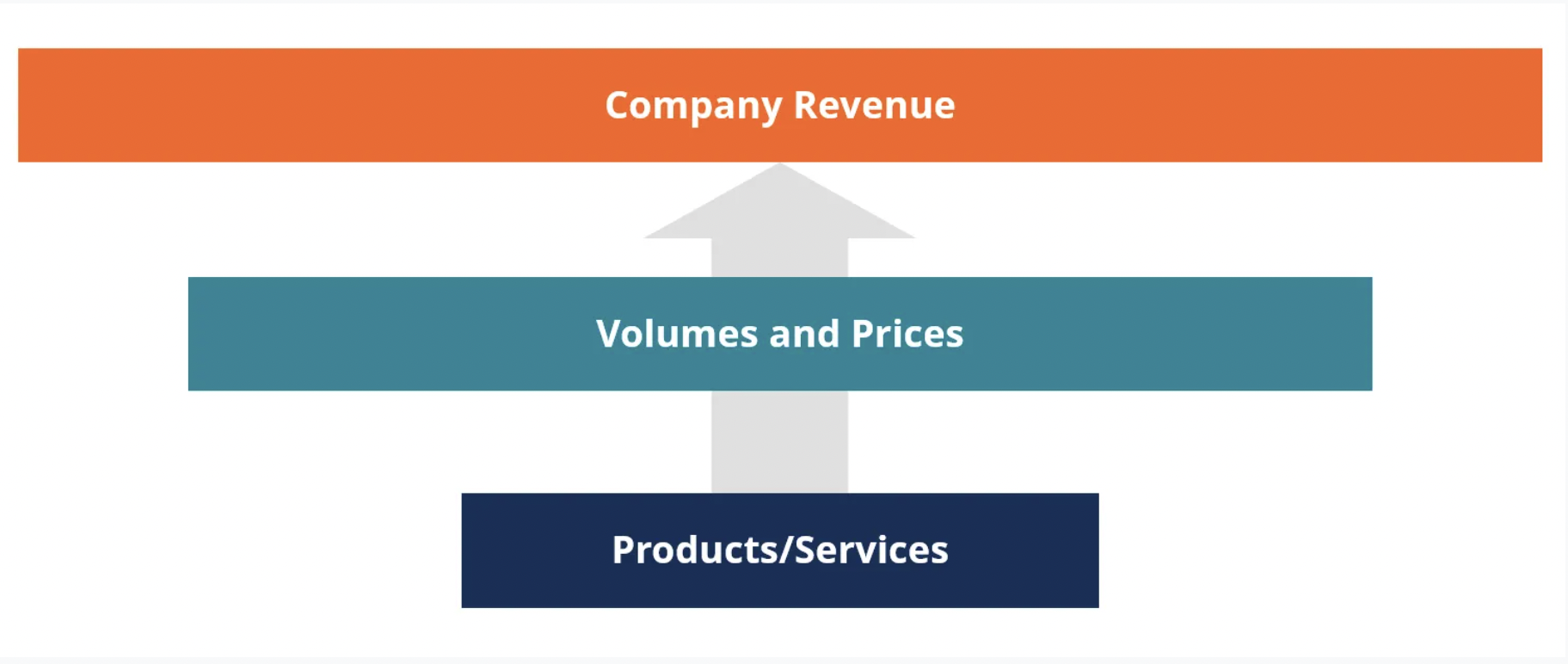

Image source: Corporate Finance Institute

The bottom-up financial model is different from the top-down model in that it begins with more specific variables, such as the individual business itself, and expands out.

For example, it examines factors such as expenses, production capacity, and total available market. The business then uses this data to create a more accurate sales projection.

Compared to the top-down model that many startups prefer in order to attract investors, the bottom-up financial model offers a more realistic view as it uses actual sales data. Some businesses may prefer this model as it can enable them to arrive at better strategic decisions.

Another benefit of this approach is that it includes employees and managers in the budgeting process. Owners may assess costs by departments, such as hiring costs, marketing fees, and distribution expenses. Business owners can then inform department managers on the best ways to manage their budgets, and managers will be more inclined to adhere to the budget as they were involved in the process themselves.

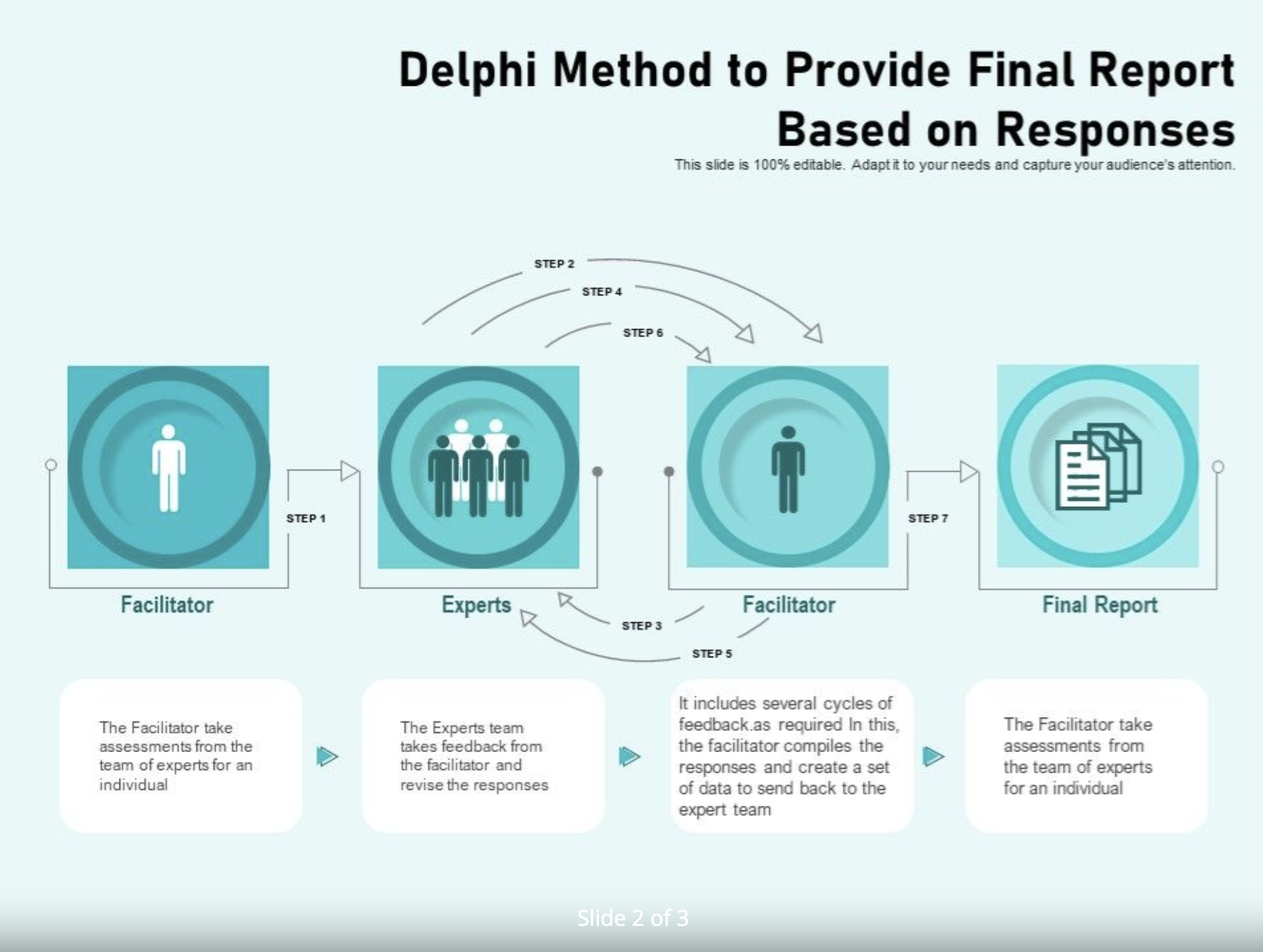

Image source: University of Phoenix

The Delphi forecasting method is based on the idea that a group of experts can forecast better than any individual expert. It's a structured technique that uses a panel of experts, a structured questionnaire, and a process of group discussion to forecast future events.

The method creates a collective forecast by repeatedly asking the group of experts to provide their anonymous forecasts, estimates, opinions, judgments, or conclusions.

The Delphi forecasting method is one of the most widely-used forecasting techniques globally that can be applied to any number of different scenarios, from planning and forecasting to public opinion polling and project management.

The technique was developed in the 1950’s by Olaf Hemler and Normal Dalkey of the Rand Corporation. The name derives from the Oracle of Delphi, the high priestess of the Temple of Apollo that was best-known for prophecies.

In short, this is how Delphi forecasting works:

The Delphi method comes with both advantages and disadvantages. One major benefit of this method is that it seeks opinions from a diverse set of experts. On the plus side, it doesn't have to be a live discussion where each member participates physically.

On the downside, live discussions tend to involve more interactions than discussions that don't happen in person. For instance, live discussions can help participants reach consensus faster as ideas are more easily discussed, broken down, and reassessed. Forecasting using the Delphi forecasting method can take weeks, if not months.

Sign up for a free trial of GrowSurf to lower your customer acquisition costs, increase customer loyalty, and save gobs of time.

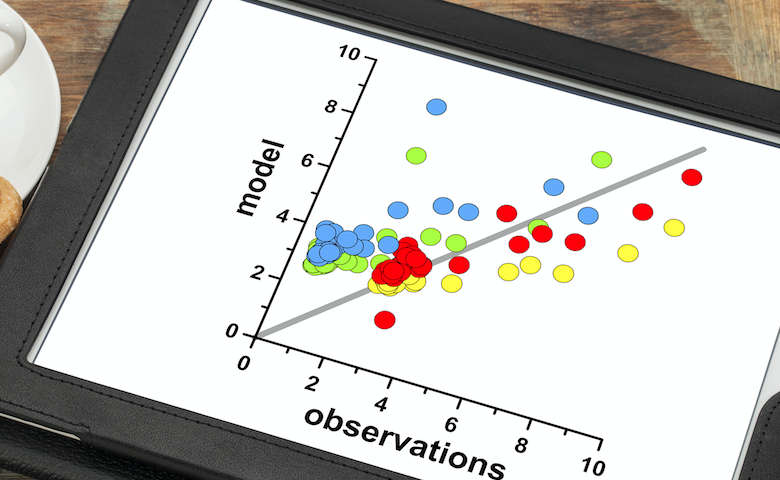

Image source: Displayr

Correlation-based forecasting models are another popular financial forecasting technique. These models pin down correlating variables and examine their relationship. For instance, by examining how prices and costs or supply and demand affect each other, decision-makers can more easily predict financial outcomes.

Quantitative forecasting models are just one of the many tools in your toolkit. And while they’re not the only way to accurately forecast demand, they are definitely one of the best.

By using these methods, businesses can create relationships between the findings of other disciplines. The end goal is to predict how your business operation compares to other similar businesses. Most commonly, these models use the Gaussian analysis that can be helpful in modeling and mitigating risks and forecast the probabilities of future outcomes.

As a startup, financial forecasting is one of the most important factors to consider.

Unfortunately, due to the lack of sufficient realistic data, many entrepreneurs put off making financial projections.

However, the good news is that by choosing the best financial forecasting model and consulting with the right people, you'll gather just enough data to make realistic financial projections.

Here are three steps to take to get started with financial forecasting for your startup.

The two most commonly used models, as discussed above, are the bottom-up and top-down models. Early-stage startups may realize they don't have enough data points to create projections using the bottom-up financial model. One way of using this approach is to use data from your competitors, but keep in mind that every business operates differently.

A better approach for early-stage businesses would be the top-down model.

Another great way to gather enough data and build realistic financial projections is to consult with your team members.

The best team members to ask for input are:

When making financial projections, focus on these three financial statements that are critical for your business:

Here's a fact:

Investors and lending institutions have seen many business owners who are overly optimistic about their business's financial performance.

The trick is to strike a balance between being optimistic and realistic. Choose the financial forecasting model that's best for your business and create realistic projections.

Making your projections reliable, that's the best way to convince investors that your business is legitimate and has the potential to grow.

To sum up:

Sign up for a free trial of GrowSurf to lower your customer acquisition costs, increase customer loyalty, and save gobs of time.

GrowSurf is modern referral program software that helps product and marketing teams launch an in-product customer referral program in days, not weeks. Start your free trial today.

Learn what made the Tesla referral program effective, bringing 40x ROI with a $0 advertising budget. Tesla's choice of referral rewards was key in their success

Customer churn analysis can bring life-changing results to your business and can be done in 3 easy steps. Learn how to calculate and reduce churn today.

These content marketing tips for financial services companies will help your business either launch or develop your content marketing strategy.

SaaS referral programs are one of the most cost-efficient ways for startups to gain new signups and paying customers. Here's 5 reasons why and examples to study

SaaS pricing can be one of the most challenging parts of operating a software company. Here is a breakdown of how to make a successful SaaS pricing strategy.

AARRR! Every startup should get familiar with these 5 letters. Learn about how you can use pirate metrics to figure out what's working and what isn't.